Chapter

01

How to Retire on $13,000 per Month in 5 Years or Less, Tax-Free

By Peter Schultz, CashflowHeavenPublishing.com

Is it really possible to retire in five years or less on $13,000 per month, tax-free? At Cashflow Heaven, that’s exactly what we teach. What we do is teach people how to safely and effectively generate cash flow from the stock market, tax-free. Once you learn how to do that, you can literally create an income—and perhaps even financial independence—from anywhere in the world you can find an Internet connection.

It is important to realize that as appealing as that sounds, you are going to need a really good plan to make it happen. The strategy needs to be safe and it needs to work consistently. The truth is,$13,000 per month is a pretty tall order. So how do we do that?

Well, it’s an especially daunting task if you try and generate that income the way most people do it—the traditional way. If you’ve met with a professional financial advisor, you know that can be a pretty sobering experience. For example if you want to generate $13,000 per month it comes to $156,000 per year ($13,000 per month x 12 months).

Conventional Investing for Retirement Requires a Lot of Money—Maybe Too Much Money

At conventional interest rates, you are going to need a lot of money working for you to generate that level of income—maybe more than you have. For example, the interest rate on the 10-year Treasury bond is hovering around 2%--and the dividend yield on the S&P 500 is also around 2%.

So at an annual rate of return of 2% you are going to need $7,800,000 to generate $156,000 per year. That's a huge amount of money. If you've got that kind of money, congratulations. However you don't have to be good at demographics or statistics to know that most of us don't. If you're dealing with somewhat less than that, you need a good plan.

Maybe you’re a little bit better at getting returns. Maybe you're a good investor—maybe you've invested in some higher-paying dividend stocks, and you can generate 5% per year. Even at 5%, you're going to need over $3 million to generate $156,000. As you can see, at today's returns and today's interest rates, you need a tremendous amount of money to create a really good income.

You don’t necessarily need to get hung up on the $13,000 per month figure. Maybe you don't need that much money, maybe you need a lot less. We're just using that as an example because that's an amount most people can live on pretty comfortably (if you keep your trips to Starbucks to a minimum!).

To Retire in Style, We Need Substantially Better Returns

To reach our goal, we need to get substantially better returns than what the conventional strategies offer. Most people have mutual funds along with some dividend stocks, but are dissatisfied with their returns and want to do better.

You may be an individual who's really investigated trading and perhaps you're doing a lot of trading right now. Some people are even day trading. The problem with that is you can get mixed results. Many active traders I’ve spoken with go one step forward and two steps backward. You can have losses, and it can be pretty stressful. Sometimes the market throws some pretty frustrating curve balls.

So even if you are an active trader and enjoy it, take a look at this method because it's a way to generate some good monthly income that tends to grow faster than any other strategy out there—and you don't have to worry so much. If you're an active trader, that alone is going to be a refreshing change. In the world of investments, however, there's always uncertainty, and if you've been out there, you know that. We need as much going for us as possible, and this plan has a mathematical probability of success that is greater than 80%.

The trick with any investing is to try and get the greatest amount of return possible for the lowest amount of risk. And that's what this program is focused on—high probability and high returns. Most investment advisors tell you that’s impossible—to get high returns you must take on higher risk—but that’s not true if you have a mathematical edge.

To Make Far Better Returns Safely—Get a Nobel-Prize-Winning Formula Working for You

How do we do that? How do we engineer high returns and a high probability of winning? We're basing our expectations on a formula that is so remarkable it won the Nobel Prize back in 1997 for the mathematicians that discovered it.

The formula was actually developed back in the early 70s, and it made standardized options and the modern options market possible back in 1973. That formula is called the Black-Scholes Options Pricing Model—and here’s what it looks like:

Now, if you are thinking that looks really complicated and wondering how are you going to figure it out, well, don’t worry—you don’t have to. The metaphor I like to use is that you don't need to know all the complex workings of the internal combustion engine to drive your car to the bank—and it’s the same idea here. You just need to know enough to take advantage of it.

We’re going to use this formula to stack the odds in our favor, and to set up a mathematical expectation of winning the majority of the time. The key to using this formula to our advantage is to be selling options instead of buying them.

This gets into a really interesting area of psychology. Most options traders are buying options. The reason is they are looking for a home run—they want to double or triple their money in a very short amount of time. And the truth is, if you buy options, you will get some big winners.

But there’s a problem with that approach. If you talk to a lot of options traders, they’ll typically tell you things were going really good for a while, and then all of a sudden they blew up their account. They lost all their money.

A funny thing happens in the stock market: sometimes the things that you think are going to happen don't. You get surprises. The market turns around. It reverses. The Fed makes a certain announcement. The company that you're betting on comes out with a warning, or whatever. Whatever you thought was going to happen didn't--and that’s what makes options buyers go broke.

How to Jump on the Right Side of Options Trading

When you become an option seller you are on the opposite side of that trade, so the odds jump considerably in your favor. A lot of surprises can happen and you can still make money. That's what I love about selling options. I've been an options trader for a long time now and I still occasionally buy an option when there's a really good setup—but the vast majority of the time I’m selling options because it’s so forgiving.

When we talk about selling options, we’re not talking about covered calls or selling naked. The strategy I’m talking about is selling credit spreads. When you sell a credit spread, you immediately take in money, and it's pretty inspiring to see that cash hit your account right off the bat.

What is a Credit Spread?

A credit spread is simply selling an option and then buying another option to hedge. The option we're selling is more valuable than the one we're buying so it creates a credit in our account. A credit, if you don't know, is money that you can use for anything you want—to buy the things you need, or to build up in your account, or to reinvest for even great profits.

So How Do We Sell a Credit Spread for Immediate Cash?

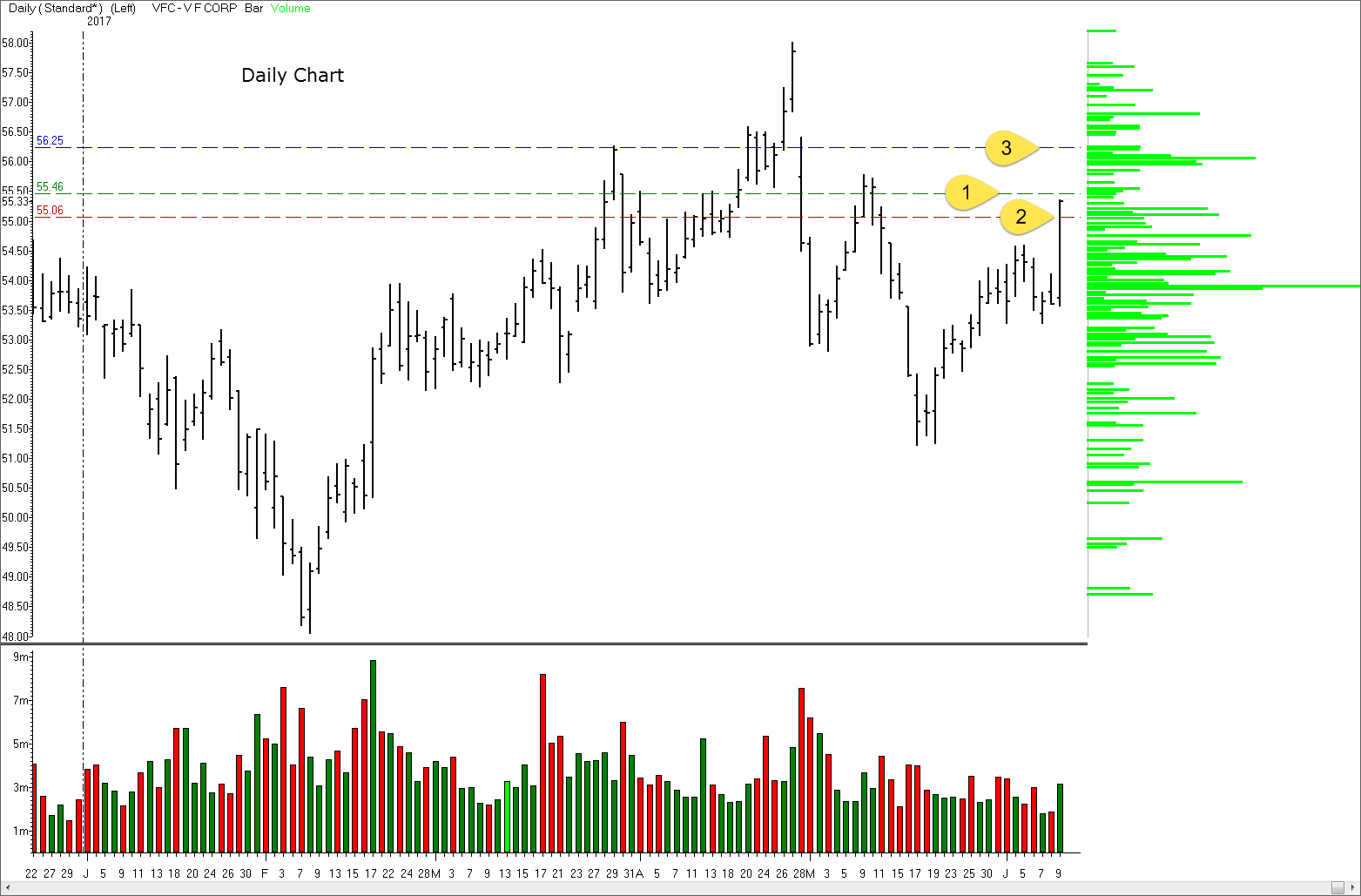

Let’s take a look. In the chart below you can see the stock going up and down, but it’s in a general uptrend. What we want to do is sell an option strike that's likely never going to get touched by the stock.

The stock is up at 107 and we’re going to sell a put option down at 99 and we're also going to buy another option as a hedge below it at 98. That limits our risk to just the distance between them, and in this case, that's just a dollar.

We're selling the 99 puts for 30 cents and buying the 98 puts for 23 cents and as you can see, there's a finish line on October 28. So in this case we’ve got about three weeks until expiration. One of the beauties of this strategy is you always know where your finish line is. At some point, in the not too distant future, these options are going to cease to exist. And if that time comes and the stock isn’t below 99—then both options expire worthless. And if you sell these spreads correctly, that’s exactly what happens the vast majority of the time.

If you ask speculative options buyers how they lost money, they’ll almost always tell you their option ran out of time before the stock could move in their direction. When that happens, the options seller is the one who makes the money. That’s who wins the majority of the time, and that’s who we want to be.

So What Can You Make on This Trade?

If we sell the 99 puts for .30 and buy the 98 puts for .23 we collect a net of .07 cents on that trade—or $700 for 100 contracts. To figure out our rate of return, we divide that .07 credit by our possible loss. The maximum that you can lose is the distance between the strikes, in this case, that's $1 but we've already taken in seven cents so the maximum we can lose is 93 cents. If we divide seven cents by 93 cents, it comes to a 7.5% return before commissions. For three weeks of time, that's 2-1/2% per week. If you get out your calculator and figure out what 2 ½% per week adds up to over time, you could become extremely rich trading this strategy.

These returns can pile up on themselves pretty quickly. It's like the old compounding illustration with the chessboard where you take a penny and put it on square one and you go to the next square and double it and go to the next square then double that, and then keep doing that for the rest of the squares on the board.

That's the way these compounding returns work—you make money on the money you just made. We get some pretty decent returns, so keep in mind, people are hoping to make 2% or 3% on their money for a year with bonds and regular dividend stocks. We're talking about making 7.5% in just three weeks!

These Returns Can Get Pretty Exciting—but It Gets Even Better…

You can also go above the stock and do the same thing with a call spread and take in another 7.5%. Now we're up to 15% for that same three weeks of time. We've got lots of room for the stock to move, but not a lot of time to do it, so you tend to win on these trades the majority of the time.

If you have a stock that's going up, you want to sell put spreads. If you have a stock that's going down, you want to sell call spreads. But oftentimes the stock is moving up and down within a range so we can sell both spreads, collect a double return, and have that stock stay within the range we’ve defined with both expiring worthless.

When we sell both call spreads and put spreads on the same stock, they are called ‘wings,’ and the whole trade is called an Iron Condor.

You can see how forgiving these trades are because we're staying away from the stock price and giving the stock room to move. The stock can go up a little bit, it can go down a little bit, it can waver all around and you still end up winning.

That Sounds Good, but How Do You Know What Your Chances of Winning Are?

You can look at the above trade and think the chances of winning are pretty good—but how do you know? Well, one of the neat things about options is that they are based on a mathematical formula. So whenever we want to sell an option, we can instantly see what the odds are that will expire worthless. That's one of the really cool advantages of this strategy—I don't know anywhere else you can do that.

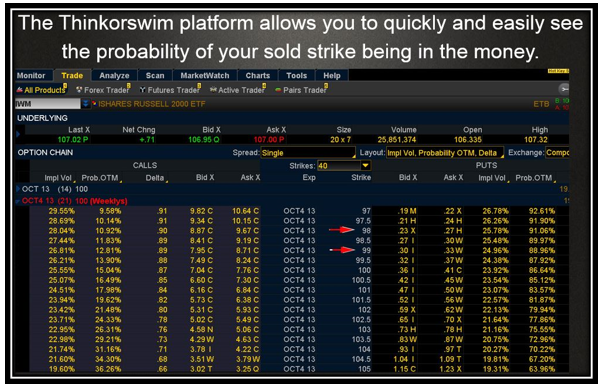

Our favorite broker for this strategy is Thinkorswim,because they have such good analytical tools, and such a great trading platform. Fortunately, with a little guidance, their platform is not hard to use—in fact, I'll show you a little bit of it right here:

This is the trading platform at thinkorswim, and if you look at the column on the far right, you’ll see a heading that says ‘Prob OTM’—that means ‘Probability of being Out of the Money’. In other words, it tells you the exact mathematical probability of this trade winning—because if the sold strike expires out of the money, the options seller wins.

One of the red arrows on the platform above points to the 98 strike price and the other points to the 99 strike price. We want to focus on the 99 strike price because that’s the one we sold. If we follow the red arrow all the way over to the far right column, we’ll see that the probability of this strike expiring out-of-the-money is 88.96%—so those are our odds of winning--which is pretty high.

It’s interesting that these probabilities actually do tend to play out over the long run, which makes your odds of winning close to nine out of 10 trades. Which is fantastic, but even on the trades that become threatened, there are things we can do to fix them when they do go against us.

Trade with Confidence Knowing You Can Fix Trades that Aren’t Working Out

We call these little fixes “adjustments” and they give you a second chance to win if the trade doesn’t work out the first time. Everybody's always very interested in adjustments because they give you a kind of “get out of jail free card” where you can fix those one out of 10 or two out of 10 trades that aren’t working out.

Knowing how to adjust gives you a lot of confidence, which is important if you are trying to use this strategy to retire.

I know it sounds crazy, but sometimes I welcome a trade that needs to be adjusted because it says 2 things:

Number 1, we're selling close enough to the underlying to have to adjust once in a while. “Selling close” means we're bringing in more money. In other words, we're right at that edge where we're bringing in the maximum amount of dollars and still trying to minimize our risk. When you do that, when you sell a little closer to the underlying, once in a while you're going to have to adjust, but that's okay because we have some great ways of doing that.

Number 2, we have the means to adjust our way out of almost any situation. That makes you feel pretty darn confident in trading this way. Now I just want to be clear upfront, it is possible to lose trading credit spreads. The market can do crazy things, so it’s good to know that even in a worst-case scenario, the amount you can lose is absolutely limited—that’s why we buy that hedge optionto limit our risk. But in any normal market situation, even if your spread is over-run, we've got ways to adjust out of it to make the trade better.

So the vast majority of the time, you can expect to win using this strategy, but it’s important to understand there is risk in trading—but we’re going to be stacking the odds in your favor as far as we possibly can.

Sounds Good. But is Anyone Actually Doing This Successfully in the Real World?

Yes—lots of people are quietly cashflowing the markets using this strategy with great success. But nobody talks about it because everyone wants to sell you on the idea of making lottery-size profitsbuying options. But once you figure out what’s really going on, you’ll realize the real money is being made by the lottery ticket sellers.

We’ve been showing people how to sell credit spreads successfully since 2010, and we’ve got a lot of people that are real believers—they tell us with great conviction they wouldn’t trade any other way.

I want to share an email I got from one of our subscribers. I just absolutely love this guy’s attitude—his name is Bob Milota. He's the kind of guy that really gets the strategy. He’s a retired engineer so he understands numbers and probabilities—Bob is a smart guy.

After doing lots of different kinds of trading, he decided that this is all he wants to do now. This is what Bob says: "As promised, here are my trading results for the year. I very nearly had an undefeated season in my high probability credit spread trading this year. Unfortunately, I suffered my first loss for the year a week ago. My record so far for the year is, 13 put ratio spreads, all done for a credit. eight iron condors, two of which consisted of three credit spreads because I closed the winning-est side and rolled in. Plus five single credit spreads, one of which is the above-mentioned loss.

That amounts to 25 wins and one loss, which is a 96% success rate.” He goes on to say, "I made a total of $19,126 making $1,594 per month and averaging a return of 9.5% per month, including all commissions and losses."

That's pretty wonderful for Bob and those like him. I know people that are taking second jobs to make an extra $500 a month—but Bob, with a few mouse clicks, is making far more. Plus he says it’s kind of fun (and I agree). He says it keeps him sharp and it keeps him interested. He's making about $1,600 per month and that amount is constantly increasing, and we've got people that are doing a lot better than that.

So the returns are there and your probability of winning is high—but can we do even better?

Building Up Your Account Quickly and Consistently is a Big Benefit—but Can We Do It Tax Free?

There is a special account where we can trade these credit spreads so that they can build to infinity without having to pay ANY tax on the profits…Ever!

This special account is called a Roth IRA.

This kind of an IRA has some special advantages that make it perfect for trading high-probability credit spreads. Here the characteristics of a Roth:

- Contributions are not tax deductible—however…

- You can contribute up to $5500 per year under age 50, and $6500 over age 50.

- Direct contributions to a Roth IRA may be withdrawn tax free at any time.

- Earnings may be withdrawn tax free and penalty free after age 59-½.

- Distributions from a Roth IRA do not increase your Adjusted Gross Income, so these earningsdo not increase your tax bracket on your other income.

- The Roth IRA does not require distributions based on age. All other tax-deferred retirement plans require withdrawals by 70½.

- Unlike distributions from a regular IRA, qualified Roth distributions do not affect the calculation of taxable social security benefits.

- Assets in a Roth IRA can be passed on to heirs.

- Single filers can make up to $110,000 to qualify for a full contribution and can make $110,000 to$125,000 to be eligible for a partial contribution.

- Joint filers can make up to $173,000 to qualify for a full contribution and $173,000–$183,000 to be eligible for a partial contribution.

As you probably noted from the list above, the most compelling characteristic of a Roth is that you can build up any amount of wealth in the account you want. And as long the distributions are taken after the age of 59-½, the money you take out is Completely Tax Free.

Combine that huge advantage with a strategy that consistently makes money, and you’ve got a blueprint to create a comfortable retirement no matter where you are starting from now.

So Your Odds of Winning are Excellent—And Now You Have a Way to Build Up Those Profits Tax Free—But How Much Can We Expect to Make?

We typically shoot for 15% to 25% returns for just two weeks of time. But it’s important to realize you want to hold back about a third of your account in cash for buy-backs and adjustments, so you’re not getting those returns on the whole account. Plus, in spite of our best efforts there will belosing trades—that’s how trading works, so we have to factor those in.

Trading this strategy with our probability of winning typically returns about 10% every two weeks. Now if you are a speculative trader, that might not sound like much—but it is when you consider your win ratio. If you are consistently making that kind of money every two weeks, you are going to be very wealthy within just a few years.

But let’s say you’re a little skeptical about those returns. Let’s say that in the real world something always happens, and our theoretical rate of return doesn’t quite materialize.

Let’s say that all you can generate is just 5% per month—not 10% every two weeks, but just 5% per month—that’s about a quarter of what we can mathematically expect even factoring in losses and holding a portion of the account in cash.

If the maximum we can put into a Roth is $6,500 per year—and we faithfully put that in every year—what does your account turn into at “just” 5% per month? Here’s what your account looks like if you invest $6,500 per year and get 5% per month over a five-year period:

As you can see from the chart above, by year two you are making approximately what Bob is making now—but by year five you are making an inspiring $12,965 per month—and the very next month that grows to $13,613 and the income grows even more steeply after that.

And your account itself has grown to over a quarter of a million dollars! At that point, you can start living off some of your profits and still see your account grow. And the inspiring thing is all it took was an investment of $6,500 per year—an amount most people can save or already have.

Which means you aren’t more than five years away from a comfortable retirement—all you need is a little know-how to make it work.

I’ve put together a complete presentation on how to trade this strategy. You’ll see our favorite way to adjust a spread if it is moving against you so you’ll never have to worry about stock reversals. I will also show you more actual examples of how to set up your trades so you really get the concept.

Plus, I’ll introduce you to others that are trading this way, including my cousin Ralph out in Chicago, and a lady that is managing a fund by selling options that is literally making millions of dollars per year. So you can see this concept works no matter how big your account gets.

And I’ll show you the proof—you’ll get a link to interviews with her where you can see for yourself what she doing. And I guarantee that you’ll come away inspired.

I believe so strongly that this strategy can make a beneficial change in your financial outlook that I want you to access this special presentation for free. It’s only about 60 minutes, but it could change your life.

Once you register, I’ll send you our Tuesday night updates so you can see for yourself how these trades work in the real world.

THE SPECIAL OFFER

So once again—click this link to watch—and I’ll look forward to showing you a little-known but amazingly effective way to create a level of cashflow that makes it more possible than ever to retire on your own terms.

Keep up the good work, and I’ll look forward to seeing you inside the presentation,

Peter

ABOUT THE AUTHOR